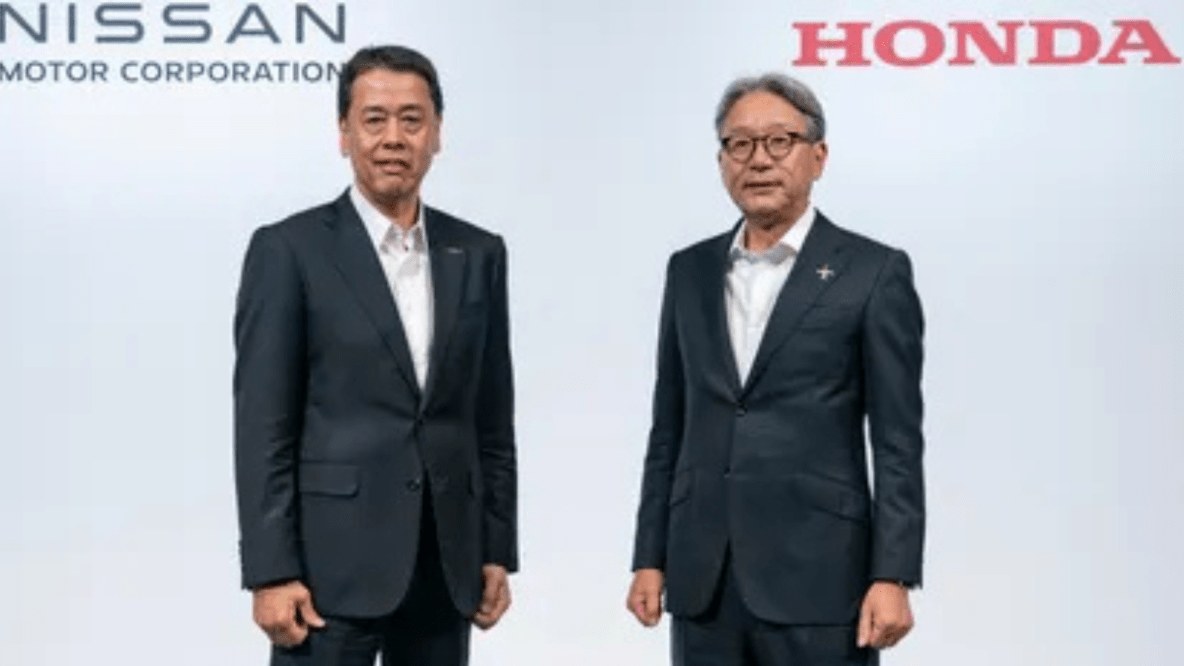

In a significant move to strengthen their market position, Japanese automakers Nissan and Honda have announced they are exploring a potential merger to form a joint holding company. The announcement, made on Monday, follows earlier discussions about collaboration on software-defined vehicles and advanced technologies, including electric vehicles.

According to reports, the proposed integration is designed to enhance the companies’ global competitiveness by merging their resources, including technology, knowledge, and human capital. This collaboration aims to create synergies and adapt to fast-changing market demands. If realized, the new entity could reach a combined annual revenue of over 30 trillion yen ($191.4 billion) and an operating profit exceeding 3 trillion yen, putting it on track to become the world’s third-largest automaker by sales.

Nissan’s CEO, Makoto Uchida, called the deal a “pivotal moment” for the company, said, “If realised, I believe that by uniting the strengths of both companies, we can deliver unparalleled value to customers worldwide who appreciate our respective brands.”

Honda’s Director and Representative Executive Officer, Toshihiro Mibe, added that while the merger is still under review, the companies are committed to exploring this direction by January 2025. “We are still at the stage of starting our review, and we have not decided on a business integration yet, but in order to find a direction for the possibility of business integration by the end of January 2025, we strive to be the one and only leading company that creates new mobility value through chemical reaction that can only be driven through synthesis of the two teams,” said Mibe.

The merger would involve creating a joint holding company that would oversee both Nissan and Honda as wholly-owned subsidiaries. Pending shareholder and regulatory approval, the companies anticipate listing the new entity on the Tokyo Stock Exchange by August 2026. As part of the arrangement, Honda will nominate most of the directors for the joint holding company. However, both companies plan to delist upon the new company’s listing, though shareholders will retain the ability to trade the shares of the new entity.

With the deal expected to culminate in a definitive agreement by June 2025 and shareholder approval in April 2026, the companies are moving cautiously but with ambition. The merger is seen as a necessary step to help both automakers keep pace with fierce global competition in the electric vehicle market, particularly from leaders like Tesla and BYD.

Analysts suggest that the deal could help Nissan overcome recent financial struggles, as the company has been grappling with restructuring efforts and declining performance, including a recent announcement to cut 9,000 jobs and reduce production capacity by 20%.

Peter Wells, a professor of business and sustainability at Cardiff Business School, commented on Nissan’s struggles, told CNBC, “Nissan has been struggling in the market, it’s been struggling at home, it doesn’t have the right product line-up. There are so many warning signs, so many red flags around Nissan at the moment that something had to happen. Whether this is the answer is another question.”

Despite the challenges, Nissan’s CEO Uchida emphasized that the merger would not negate its turnaround efforts. “After doing this turnaround action for future development, future growth, we need to look at ultimate size and growth. This growth will be through partnerships,” he said.

In parallel, Mitsubishi, a strategic partner of Nissan, has been offered a chance to join the new group and will announce its decision by January 2025.

The announcement has caused significant movement in the stock market, with Nissan shares rising 1.2%, while Honda saw a 3.8% increase. Shares of Mitsubishi also saw a modest rise of 0.6%.

Leave a Reply